Fastener supply & inventory management

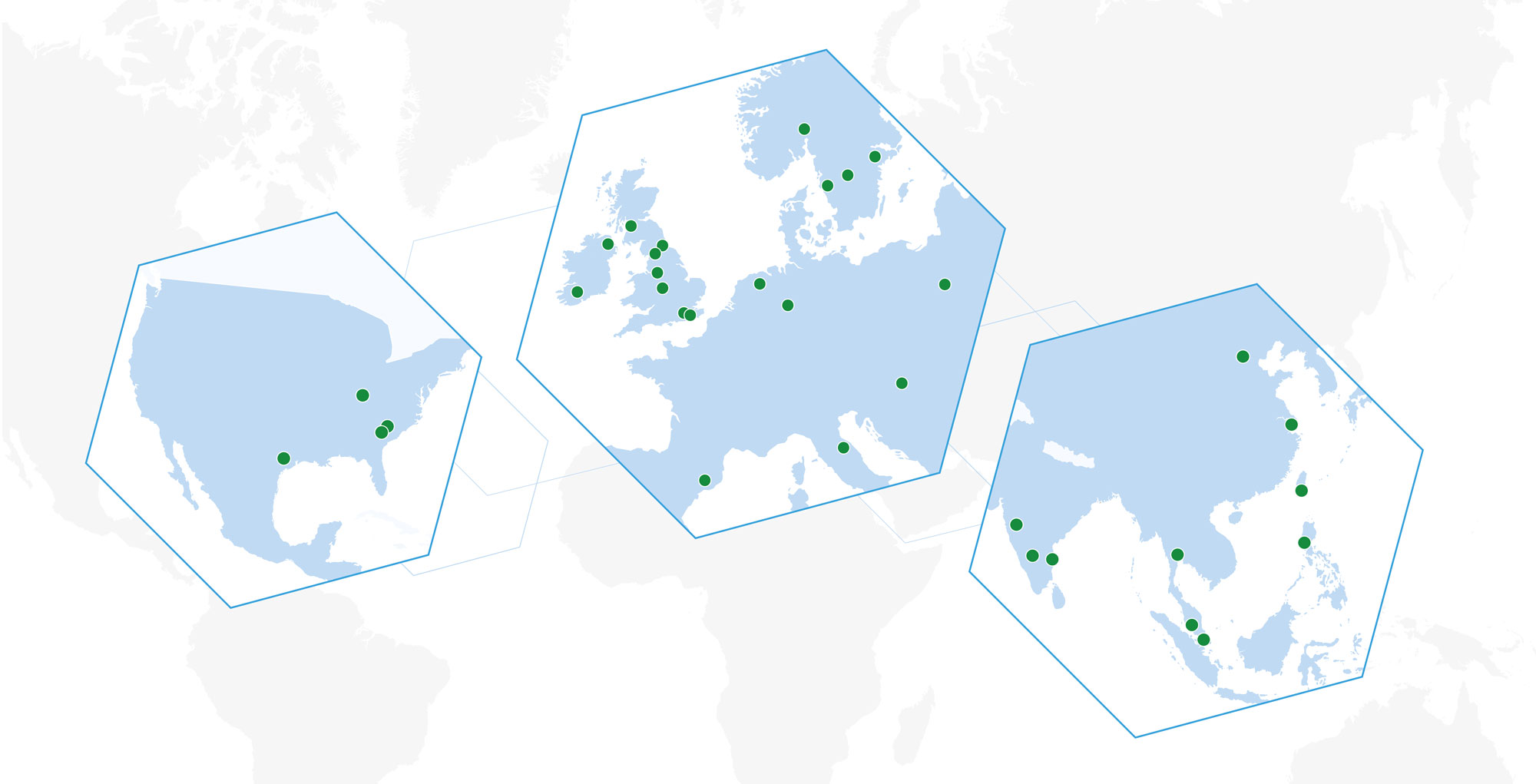

TR Falcon Fastening Solutions, Inc., part of the Trifast plc group, is a distributor of industrial fasteners and other Cat C components and is a specialist in vendor managed inventory (VMI) for original equipment manufacturers (OEMs)

COMPANY

About us

Today, TR Falcon Fastening Solutions has full-service distribution centers in Charlotte NC and Louisville Kentucky with onsite VMI locations in clients facilities in these regions.

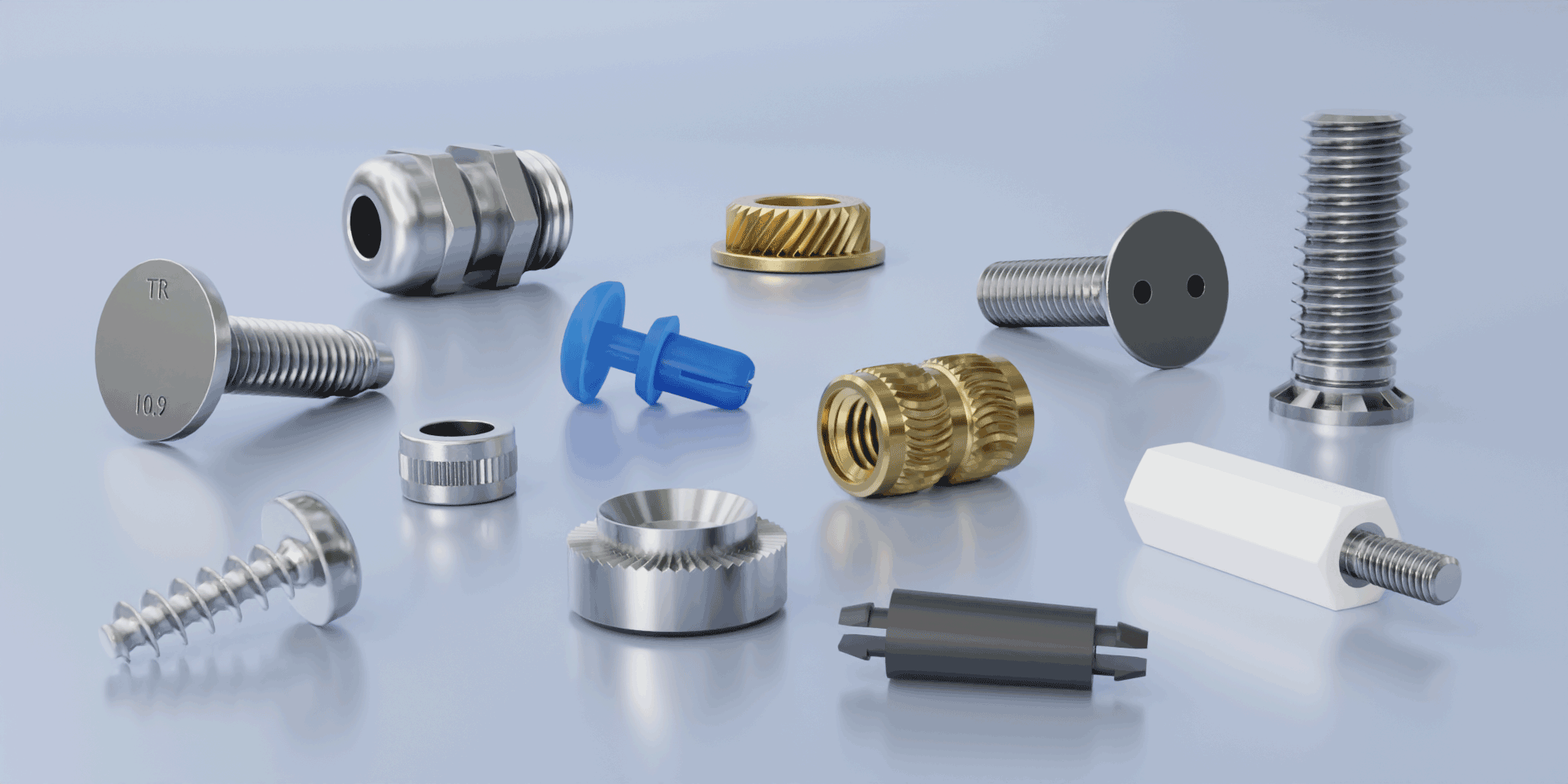

PRODUCTS

Not just fasteners

We have an extensive supply chain capability enabling us to supply a wide variety of fasteners including Class C components you want. Increasingly we are providing kitted product to reduce the total cost of ownership (TCO).

VENDOR MANAGED INVENTORY

VMI programs

Our tailored vendor managed inventory (VMI) programs are bespoke to meet your requirements. We can conduct on site surveys and produce a compatibility report to ensure we meet the brief.

FULL SERVICE PROVIDER

Value-added services

We offer kitting services as well as subassembly in addition to all of our cost reduction services like local delivery, vendor and invoice consolidation and more.

SERVICES

Account management

A dedicated account manager will research your best supply source, manage your inventory levels, and search for cost savings.

South Carolina

Technical and Innovation Centre

CU-ICAR - One Research Drive, Office 300E, Greenville, SC 29607, USA

Phone: +1 800-280-2181

Email: usa@trfastenings.com

North Carolina

TR Falcon Fastening Solutions

10715 John Price Road, Charlotte, NC 28273

Registered in USA | Registered No: C201409701782

Phone: +1 704-588-4740 or +1 800-438-0332

Email: connect@falconfastening.com

Kentucky

TR Falcon Fastening Solutions

11536 Commonwealth Drive, Louisville, KY 40299

Phone: +1 704-588-4740

Email: connect@falconfastening.com

Latest news

Keep up to date with the latest fastener, industry and Company news from TR and our Group of companies.